Commercial Property: 2025 Outlook

Acure Asset Management provides in-house research, analysis and news bulletins to subscribers on a monthly basis.

Our reports are based on Australian Property and Market trends as they happen – as well as reflective reports on our portfolio and performance.

Subscribe for more tailored News and Insights from Acure Asset Management below or on our Contact page

As 2025 begins, the commercial property market is demonstrating solid momentum, with investor confidence remaining high.

We saw this momentum occur in the second half of last year, where record prices and yields were achieved.

Australia’s commercial property market is entering a phase of renewed stability and optimism. Following recent times of uncertainty, key indicators such as inflation and interest rates are showing signs of steadying, creating a more predictable environment for investors and businesses alike.

“Investors acquiring assets now – after values have adjusted down but not yet commenced the recovery – will be well-placed to see strong returns in years to come,”

– Knight Frank chief economist Ben Burston.

“Core industrial and CBD office assets in Sydney will lead the way before the recovery extends to other cities.” “Commercial real estate valuations are expected to stabilise in 2025, accompanied by a gradual recovery in transaction volumes,”

– Cushman & Wakefield ANZ chief executive Noral Wild.

Top 5 Market Predictions 2025

1. Economic recovery as rate cuts loom

According to Ray White’s Property Outlook Report 2025, the rising cost of living is putting pressure on the RBA to provide some relief to mortgage borrowers through lower rates. Several factors will influence when and by how much the RBA cuts rates. According to Cushman & Wakefield’s 2024 EOY Market Commentary & 2025 Forecast, the Australian economy is expected to recover as inflation eases and the RBA slashes interest rates. The national outlook reflects cautious optimism, with signs of recovery across key sectors and long-term growth potential.

2. Commercial property to return to growth status

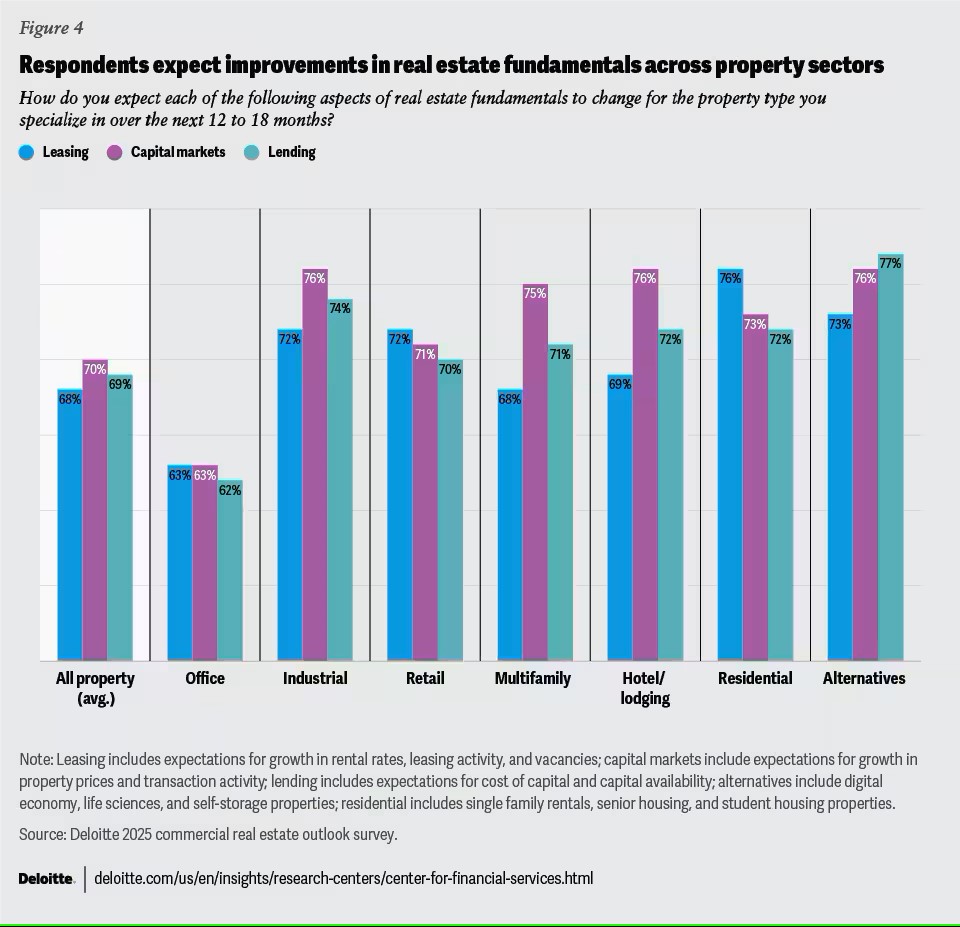

Well-located core assets have now largely repriced and are poised to start recovering in 2025, with pricing, if not yet formal valuations, now at a cyclical low. Commercial real estate capital markets are rebounding, with 2024 investment volumes surpassing the total for 2023 by $1 billion within the first nine months, with the growth trend expected to continue. Investment volumes for office, retail and industrial properties exceeded 2023 levels late last year, while alternative assets are on track to match last year’s performance.

3. Office leasing is back, but only at the top end

High office vacancy rates in most markets and elevated incentives continue to point to the need for caution in bringing forward new office developments, and many markets appear oversupplied at the aggregate level. After several years of reducing office space requirements, portfolio expansion is back on the cards, with office attendance policies to shift towards an average of four days a week. The slowdown in commencements is now clearly impacting the pipeline, particularly in Sydney and Brisbane, which will act to drive up face rents on new developments and aid the Sydney market recovery.

4.Investors ready to re-enter the market

After nearly three years with markets in a state of flux, many investors have reset their expectations and are ready to hone in on their preferred investment opportunities. Commercial real estate investments have a long track record of outperforming on returns. Some of the highest five-year returns were achieved with investments transacted between 2009 and 2011, in the immediate aftermath of the global financial crisis (GFC).The retail sector will see private investors strategically target metropolitan assets underpinned by strong trade-area demographics and essential service offerings.

5. Focus on risk mitigation

There is much greater focus now on the scale of potentially obsolete assets across the real estate spectrum, as a result of shifting preferences for how space is used, changing patterns of urban development and tightening sustainability requirements. Building age and design, location and ESG considerations are the key factors commercial real estate owners should take into account when making strategic decisions about their assets, particularly as new sustainability legislation is implemented in 2025 and as 2030-35 city and national net-zero targets approach. The continued reshuffling of office users into top-quality spaces will begin to open up ample repositioning and retrofitting opportunities for real estate owners now and into 2026.