Back To The Office: Momentum in the Sector

Acure Asset Management provides in-house research, analysis and news bulletins to subscribers on a monthly basis.

Our reports are based on Australian Property and Market trends as they happen – as well as reflective reports on our portfolio and performance.

Subscribe for more tailored News and Insights from Acure Asset Management below or on our Contact page

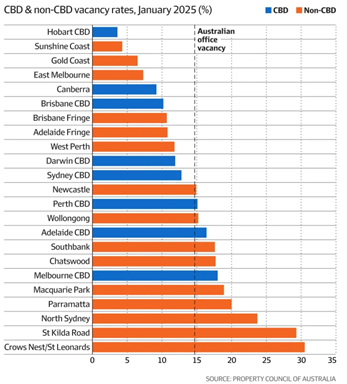

The strong performing office market in the Gold Coast was highlighted in an article in Robert Harley in the AFR. The article reported on the release of Property Council of Australia’s Office Market Report which showed the Gold Coast had the third lowest vacancy rate in the nation.

Jennelle Wilson, Knight Frank’s research and consulting partner in Queensland, says the Fringe has been boosted by a supply of quality new space highly sought after by tenants looking to improve their workplace amenity.

Ross Lees, managing director of Growthpoint Properties Australia, told the recent CBRE Talking Property podcast he was optimistic about the sector in 2025 but more so in 2026 and beyond.

“We’ve probably got the highest yield coming out of office today relative to all other opportunities that exist,” he said.

The Property Council numbers show that in 2024, Australian businesses and governments actually occupied more office space than they exited.

JLL, which calculates the numbers on a more forward-looking basis, reports that more office space was taken up in Australia’s key office markets than in any year since 2018.

Brisbane has been a standout. JLL’s head of office leasing in Australia, Tim O’Connor, points to an encouraging diversity of demand across public, professional services and mining sectors.

Gold Coast Office Vacancy Hits Record Low Of 2.0%

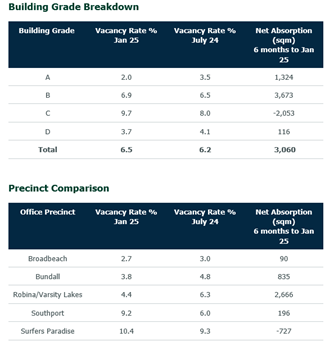

The Gold Coast continues to have one of the most constrained office markets in the country, as highlighted by the latest Property Council of Australia’s six-monthly Office Market report.

The A-grade office market has reached a historic low vacancy rate of just 2%, or 1,754 sqm of available stock. This underscores the ongoing demand for high-quality commercial properties over the past five years and the challenges faced by both existing and new businesses in securing suitable locations to meet their future requirements on the Gold Coast.

While the Robina/Varsity Lakes, Broadbeach, and Bundall precincts are all reporting vacancy below 5%, Southport and Surfers Paradise have higher vacancy rates of 9.2% and 10.4%, respectively.

The lack of new supply over the coming years is expected to further exacerbate market conditions, with no new projects currently underway or likely to start until later this year, with likely delivery in mid to late 2027.