Transparency: Putting Investors First

Acure Asset Management provides in-house research, analysis and news bulletins to subscribers on a monthly basis.

Our reports are based on Australian Property and Market trends as they happen – as well as reflective reports on our portfolio and performance.

Subscribe for more tailored News and Insights from Acure Asset Management below or on our Contact page

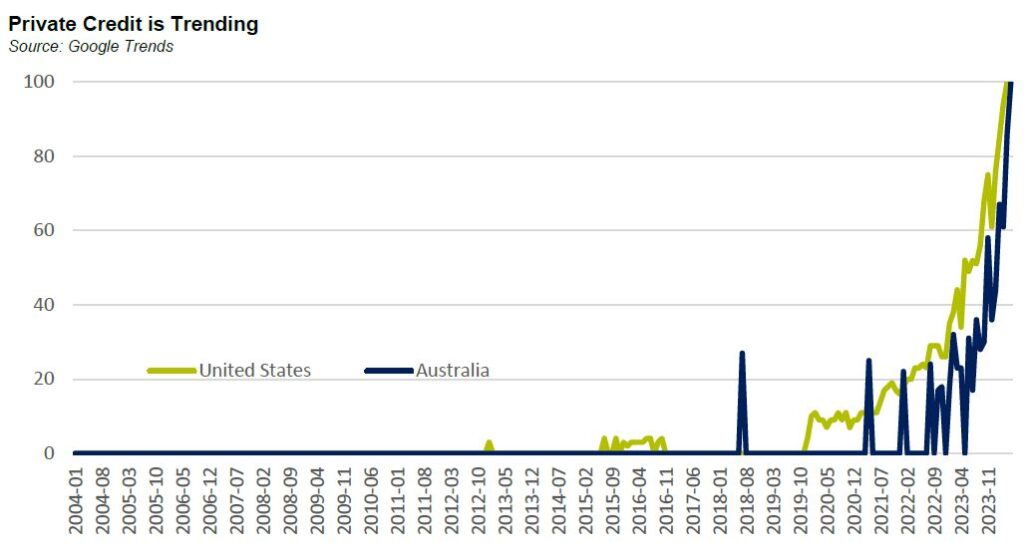

There’s been a bit of a storm in the world of private credit recently with investors cautiously watching for signs of movement in response to increased risks and regulatory attention.

The corporate regulator has ratcheted up its surveillance of the rapidly expanding private credit funds sector, where there has been a series of defaults and collapses, demanding details on governance, valuation modelling and investor protection measures by mid-April.

The regulator will focus initially on private credit funds that have raised money from wholesale investors. The second stage will examine practices of private credit funds that have raised money from retail investors and are therefore subject to more stringent disclosure requirements.

SQM Research noted the “rapid increase” in private credit funds offered to wholesale investors, which did not adhere to the same disclosure and transparency requirements of funds marketed to retail investors.

The questionnaire raised issues that ASIC has previously identified as areas of concern about the sector: governance, valuation practices, management of conflicts of interest, and the fair treatment of investors.

Stability in Strategy

Whilst Acure does not operate in the private credit space, the recent focus has highlighted the importance of transparency in the investment process and the role of governance, valuation practices, conflicts of interest, and the fair treatment of investors, which are common considerations on all investments.

When considering offerings to sophisticated investors, Acure’s strength lies in its 𝗮𝗯𝗶𝗹𝗶𝘁𝘆 𝘁𝗼 𝗿𝗲𝗺𝗮𝗶𝗻 𝘄𝗵𝗼𝗹𝗹𝘆 𝘁𝗿𝗮𝗻𝘀𝗽𝗮𝗿𝗲𝗻𝘁 throughout acquisition, management and value-add processes.

Acure acquires commercial property assets that are 𝗯𝗲𝗹𝗼𝘄 𝗿𝗲𝗽𝗹𝗮𝗰𝗲𝗺𝗲𝗻𝘁 𝗰𝗼𝘀𝘁, 𝗵𝗮𝘃𝗲 𝘀𝘁𝗮𝗯𝗹𝗲 𝗶𝗻𝗰𝗼𝗺𝗲 𝗮𝗻𝗱 𝘀𝘁𝗿𝗼𝗻𝗴 𝗰𝗮𝗽𝗶𝘁𝗮𝗹 𝗴𝗮𝗶𝗻𝘀 𝗽𝗼𝘁𝗲𝗻𝘁𝗶𝗮𝗹. Acure’s experienced management team 𝗽𝗿𝗶𝗼𝗿𝗶𝘁𝗶𝘀𝗲𝘀 𝗰𝗹𝗶𝗲𝗻𝘁𝘀’ 𝗶𝗻𝘁𝗲𝗿𝗲𝘀𝘁𝘀, with a focus on proactively maximising returns.

Our prudent and conservative approach to risk management has been a staple of our success in the property industry for over 13 years, and the results of our realised trusts speak for themselves.

Simple. Effective. Acure.

Our Industrial trust No.1 is a great example of our commitments to our investors, where active management and strategic purchasing allowed Acure to realise an 𝗮𝘃𝗲𝗿𝗮𝗴𝗲 𝟲𝟴% 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗲 𝗶𝗻 𝗰𝗮𝗽𝗶𝘁𝗮𝗹 𝘃𝗮𝗹𝘂𝗲 across the 3 properties for our investors, combined with a stable 𝗶𝗻𝗰𝗼𝗺𝗲 𝘆𝗲𝗶𝗹𝗱 𝗼𝗳 𝟭𝟭% 𝗽.𝗮, resulting in over 𝟭𝟴% 𝗽.𝗮 𝗜𝗥𝗥.

Similarly, our Hamersley Unit Trust, which sold in 2021 for a 𝟲𝟲% 𝘂𝗽𝗹𝗶𝗳𝘁 𝗶𝗻 𝗰𝗮𝗽𝗶𝘁𝗮𝗹 𝘃𝗮𝗹𝘂𝗲, returned 𝟭𝟳% 𝗽.𝗮 𝗜𝗥𝗥 𝗳𝗼𝗿 𝗶𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀.

And more recently, our fully subscribed Emerald Lakes trust was recently valued at a 𝟮𝟰% 𝘂𝗽𝗹𝗶𝗳𝘁 𝗶𝗻 𝗰𝗮𝗽𝗶𝘁𝗮𝗹 𝘃𝗮𝗹𝘂𝗲 𝗮𝗳𝘁𝗲𝗿 𝗷𝘂𝘀𝘁 𝟯 𝘆𝗲𝗮𝗿𝘀 𝘂𝗻𝗱𝗲𝗿 𝗺𝗮𝗻𝗮𝗴𝗲𝗺𝗲𝗻𝘁, boasting an 𝟴.𝟲% 𝗽.𝗮 𝗱𝗶𝘀𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗼𝗻 𝗶𝗻𝗰𝗼𝗺𝗲 𝘆𝗶𝗲𝗹𝗱 𝗳𝗼𝗿 𝗶𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀.