Brisbane Office market: The Gold Standard

Acure Asset Management provides in-house research, analysis and news bulletins to subscribers on a monthly basis.

Our reports are based on Australian Property and Market trends as they happen – as well as reflective reports on our portfolio and performance.

Subscribe for more tailored News and Insights from Acure Asset Management below or on our Contact page

Brisbane’s office market demonstrated resilience and positive momentum throughout the second quarter of 2025, outperforming other Australian capital city markets in rental growth and tenant demand. Knight Frank’s latest “State of the Market” report confirms Brisbane’s continued emergence as a standout performer, underpinned by tightening incentives, solid occupier activity in premium buildings, and stabilising investor sentiment.

The Brisbane Office Market continues to validate the investment strategy of the Brisbane Office Trust which is buying an A-Grade office in Coronation Drive, Milton QLD. The offer is now open for investment, and details of the offer can be found at the bottom of this page.

Strong Growth in Prime Rents

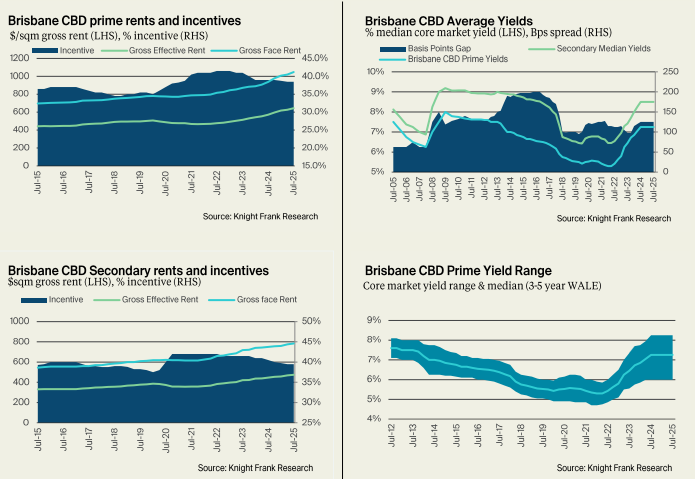

Prime office rents in the Brisbane CBD saw continued upward pressure over the April–July period. Gross face rents rose by 2.7% over the quarter, bringing year-on-year growth to 11.7%.

Although this marks a moderation compared to the exceptional growth recorded through 2024, it still reflects strong underlying demand for high-quality office space. Net effective rents for prime-grade assets reached an average of $448 per square metre per annum—an impressive 22.6% annual increase.

Secondary stock also recorded solid performance, with net effective rents rising to $289 per square metre, reflecting a 15.3% annual lift. These figures indicate that while the prime segment continues to lead the market, the rental uplift is spreading into lower-grade assets as well.

A key driver behind this rent escalation is the ongoing reduction in incentive levels. Prime incentives are now averaging between 35% and 38%, down from 38.2% at the same time last year. This compression in incentives is allowing landlords to achieve stronger effective returns, contributing to a more confident investment landscape.

Vacancy and Tenant Demand

Despite the healthy rental performance, the market recorded a modest net absorption decline of approximately 12,646 square metres over the first half of 2025. While this might seem like a red flag at first glance, the underlying dynamics tell a more nuanced story. The dip was largely the result of increased churn from smaller occupiers and the expiry of older, short-term leases rather than a broader pullback in tenant demand.

In fact, demand for quality office space remains firm, particularly for Premium and A-grade assets. The vast majority of tenant movements during the quarter involved leases under 250 square metres, with renewals dominating the landscape as businesses continue to weigh relocation costs against uncertain economic conditions.

Nevertheless, market confidence is building, and analysts expect that larger occupiers will begin re-entering the market with new lease requirements in the second half of the year, particularly as more high-end space becomes available.

Investment Market and Outlook

The investment market is beginning to show signs of recovery following a period of subdued activity. Prime office yields have stabilised at around 7.25%, aided in part by easing interest rates and a more balanced risk appetite among institutional investors. These dynamics are encouraging greater buyer engagement, with expectations that transaction volumes will rise steadily in the second half of 2025.

The broader outlook for the Brisbane CBD office market is increasingly positive. Knight Frank forecasts a mid-year transition into recovery, buoyed by sustained economic growth, increasing tenant activity, and limited upcoming supply. A continued flight-to-quality trend will likely underpin leasing demand, combined with pressure from lack of supply due to the 2032 Brisbane Olympic Games infrastructure commitments.

Summary

In summary, Brisbane’s CBD office market remains one of the strongest performers nationally. Prime and secondary rents are rising, incentives are shrinking, and tenant interest is focused firmly on high-quality space. Although net absorption turned negative in Q2, the underlying sentiment and leasing pipeline suggest a near-term rebound, with larger occupiers expected to drive leasing momentum in the months ahead.

As the market transitions into the second half of 2025, attention will turn to the rollout of new premium developments and the extent to which these assets attract pre-commitments. Investor confidence is gradually returning, and the fundamentals—tightening supply, elevated tenant expectations, and a preference for core assets—continue to support a favourable outlook for landlords and syndicate investors alike.

Now Open For Investment: Brisbane Office Trust

With Brisbane’s CBD and near-CBD Office Market leading the nation-wide Office sector recovery, The Brisbane Office Trust presents a compelling opportunity for counter-cyclical investment in one of the nations most constrained markets. With the 2032 Brisbane Olympic Games around the corner, and significant commitments to infrastructure throughout Brisbane, we expect office vacancy to tighten even further over the 5-7 year investment term, as yields and absorption continue to trend positively for landlords and investors alike.

Attractive Investor Returns

- Equity raise of $53 million with 45% gearing

- Monthly distributions, commencing at 9% p.a.

- Projected average 5 year distribution yield of 9.6% p.a.

- Target Total Return (IRR) over the 5-7 year investment term 14.0% p.a. (after all fees)

Property Highlights

- The Property has 12,980 sqm of lettable area over 5 levels and 315 car bays

- Large 2760 sqm floor plates

- Diversified tenancy profile with 15 tenancies

- The Property is currently 93% occupied with a WALE of 3.4 years (incl. rent guarantee)

- Purchase price $80 million ($6,163/sqm) representing a fully leased yield of 10.1% and a 42% discount to replacement cost.