New Cycle, New Risk, New Opportunity

Acure Asset Management provides in-house research, analysis and news bulletins to subscribers on a monthly basis.

Our reports are based on Australian Property and Market trends as they happen – as well as reflective reports on our portfolio and performance.

Subscribe for more tailored News and Insights from Acure Asset Management below or on our Contact page

The RBA on Tuesday cut the cash rate by another 25 basis points, to 3.85%. The cut illustrates that the RBA has shifted the focus of policy to supporting growth, which has become more important since their last meeting in early April given downside risks to the global outlook.

While the global trade environment brings forward new risks, the good news for property is that with the devaluation cycle now ending, the bad news has largely already been priced in so markets are insulated from further downside risk, with uncertainty now more concentrated on the timing and speed of recovery.

Nearly halfway through 2025, it is clear that property markets are sequentially turning the corner back to growth, in line with our predictions in the 2025 Horizons report.

After a divergent and disruptive downturn, retail and industrial asset values were first to start the recovery, with all segments and cities returning to growth in late 2024. Office values have also now turned positive in Q1, off the back of improving prospects for core CBD assets despite pockets of over-supply elsewhere.

Linked to a much-improved outlook for asset values, liquidity is also returning. Large single asset and platform acquisitions are now more frequent across all sectors, while capital raising is becoming easier as investors eye the opportunity for cyclical recovery from a more attractive entry point, with downside risks now much reduced.

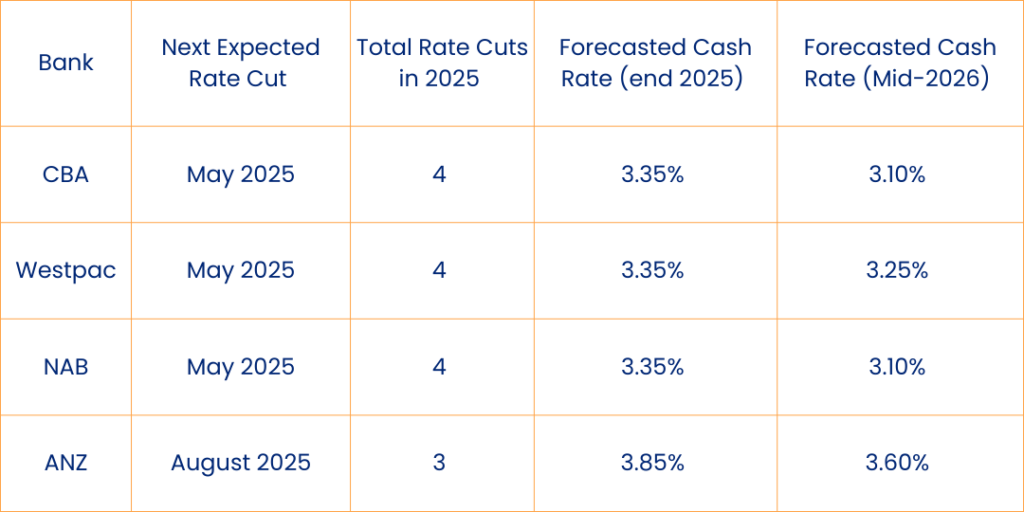

The nascent recovery has been due in large part to the gradual improvement in the macro-outlook since the middle of 2024, starting with the commencement of the rate cutting cycle overseas which buoyed sentiment by signalling a decisive shift away from the contractionary policy stance of 2022- 23. Australia has been late to the party, with inflationary pressure more persistent than in other major economies during 2024. But sequential quarterly data releases in January and April have been reassuring and the RBA has now cut rates twice.

In Focus: Supporting Growth

In each of these elements, events have proceeded very much as we expected late last year. However, the announcement – and subsequent partial retraction – of substantial tariffs on all major economies by the US has come as a shock, resulting in significant volatility in equity markets and posing a series of unanticipated questions for property investors.

Clearly, the tariffs introduce a new form of trade policy uncertainty with material downside risks to economic growth. Equity markets may have substantially recovered from the initial shock, but sentiment is fragile, and economists are revising down the outlook for growth in the US and globally.

Notwithstanding the risk of slower global growth, property markets will respond to the rate cutting cycle, and the shift in the outlook raises the prospect of yield compression in the second half of the year, starting in the most favoured core markets.

Demand for prime industrial & logistics property is resurgent, with competition ramping up for high quality assets in Sydney and Brisbane. Yields are already starting to edge down in Brisbane, and we expect to see yields sharpen in Sydney in coming months.

PORT IN A STORM

The good news is that post devaluation cycle, the bad news has largely already been priced in, and markets are insulated from further downside risk, with uncertainty now more concentrated on the timing and speed of recovery.

In this respect, property is better placed than other asset classes to withstand the trade war. Volatility in equity and fixed income markets highlights that they are subject to more immediate risks, so there is a strong case to raise allocations to property, reversing the 2022-23 trend when many investors stepped back from the market.

Office Market Showing Opportunity for Counter-cyclical Plays

The Australian office market in 2024 demonstrated clear signs of recovery, providing valuable insights into emerging trends. We’ve witnessed the highest annual CBD net absorption since 2018, indicating a renewed confidence in office space as a vital business asset. Several markets stood out in 2024. The Sydney CBD recorded its strongest annual net absorption since 2015, while Brisbane’s CBD vacancy rate fell to a 12-year low. Adelaide also performed exceptionally well, with annual net absorption tripling its 20-year average. Looking ahead, the flight to quality will likely continue to shape market dynamics. Assets with superior amenities, strong sustainability credentials, and prime locations near public transport consistently outperform.

This trend is expected to persist as companies increasingly view high-quality office space as crucial for talent attraction and retention. While organisations maintain a disciplined approach to headcount growth, the start of the declining cash rate cycle, and the resilient Australian labour market suggests continued strategic hiring to support growth ambitions. This bodes well for ongoing demand in the office sector, particularly for prime grade assets. The evolution of workplace norms is also influencing the market. We’re seeing office spaces being continually refined to enhance productivity, collaboration, and employee wellbeing.

THE RISE IN IMPORTANCE OF AI

The impact of AI on commercial real estate (CRE) is becoming increasingly evident. According to research, 90% of companies plan to integrate AI to support human experts in CRE over the next five years. This transformation is already visible in major markets. Early AI adopters have significantly boosted net office space take-up in Sydney and Melbourne CBD markets. Since 2020, AI companies have consistently leased over 10% of total Bay Area leasing volume in the U.S. In Australia, AI jobs are projected to surge by 500% between 2023 and 2030, potentially adding 166,400 new positions.

OUTLOOK FOR 2025 AND BEYOND – HOW WILL AI IMPACT OFFICE DEMAND?

AI is set to reshape Australia’s office market landscape by 2030. If the demand trends continue, JLL projections indicate potential demand for nearly 500,000 sqm of additional office space, driven by AI adoption. Sydney and Melbourne are expected to lead this transformation, becoming key clusters for AI companies. Previous experience with major technological advancement has shown that improvements have greater more jobs than they have displaced. Some of the jobs we are seeing created through the expansion of AI include development, data-related positions, cybersecurity and ethics and governance. We believe in the evolution of human-centric AI where a symbiotic relationship exists between humans and AI, where the strengths of both are leveraged to create better outcomes.

In conclusion, the 2024 performance of the Australian office market indicates a sector in recovery and adaptation. As we look to the future, the office market appears well positioned to meet the evolving needs of businesses, supporting their growth and workforce strategies in a dynamic economic landscape.