Volatility: CRE a Safe-Haven in Treacherous Tariff Seas

Acure Asset Management provides in-house research, analysis and news bulletins to subscribers on a monthly basis.

Our reports are based on Australian Property and Market trends as they happen – as well as reflective reports on our portfolio and performance.

Subscribe for more tailored News and Insights from Acure Asset Management below or on our Contact page

Investing in unlisted property funds offers many advantages, with tax-deferred income being one of the most valuable yet frequently misunderstood features. For investors seeking both regular income and tax efficiency, understanding this concept is crucial to making informed investment decisions.

Tax-deferred income is a portion of your investment distribution that is not immediately taxable in the current financial year. Instead, the tax obligation is postponed until a future date, typically when you sell your investment.

In unlisted property funds, tax-deferred income arises because of the difference between:

The cash amount the fund distributes to investors, and The lower taxable income amount the fund reports after claiming non-cash deductions.

This difference occurs because property funds can claim non-cash deductions such as:

- Building depreciation (the gradual reduction in value of physical structures)

- Plant and equipment depreciation (for items like air conditioning, elevators, etc.)

- Capital works allowances (deductions for construction costs)

These deductions reduce the fund’s taxable income without affecting the cash available for distribution to investors.

For investors, this means:

- You receive your full cash distribution

- Only a portion of that distribution is immediately taxable at your marginal tax rate

- The tax-deferred portion isn’t taxed now but reduces your “cost base” (the original amount considered as your investment for tax purposes)

When you eventually sell your investment, you’ll pay capital gains tax on a larger amount due to this reduced cost base

For example, if a fund has a 70% tax-deferred component and distributes $1,000 to you, only $300 is immediately taxable, while $700 reduces your cost base and will be factored into your capital gains calculation when you sell.

Targeted, Stable, and Long Term.

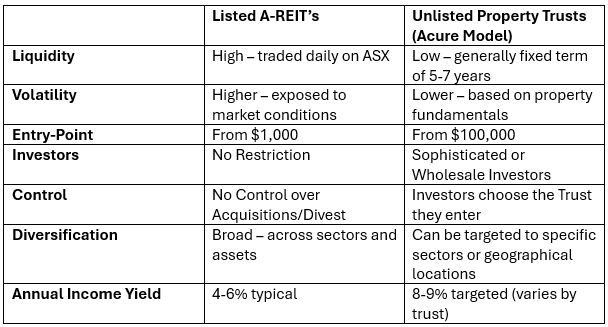

Unlisted property trusts provide access to direct commercial property without being listed on the stock exchange. These funds are often structured for long-term performance and stability, appealing to investors who value consistency over liquidity.

Unlisted trusts can be either:

- Open-ended, accepting new capital regularly, or

- Closed-ended, with a fixed pool of investors and a set investment term (often 5-6 years)

Why investors choose Unlisted Property Trusts:

- Consistent returns: Income from long-term leases, often at higher yields than listed A-REITs

- Reduced volatility: These funds typically value their assets on a regular basis (quarterly or bi-annually) using independent third-party appraisers. As a result, valuations tend to reflect the true value of the underlying property, which can lead to more stable returns. Since these funds are not impacted by daily market sentiment, they offer less volatility compared to REITs.

- Strategic focus: Funds may specialise in sectors like shopping centres, large format retail, logistics, healthcare or regional hubs

- Tax efficiency: Potential for depreciation benefits and capital gains tax discounts

- More control: Especially in closed-ended structures, investors can select the exact fund and exposure they prefer

The Acure Model

At Acure, our unlisted trusts are designed for stability and income, with recent offerings targeting annual yields of 8-9%, distributed monthly. Additionally, they provide potential for substantial capital growth which is realised at the close of the Fund.